Click Here to view our Terms and Conditions in a new tab (PDF format). 2-Pearl Short Form Updated

Pearl Prepaid Mastercard Cardholder Agreement

IMPORTANT – PLEASE READ CAREFULLY

1. Terms and Conditions for the Pearl Prepaid Mastercard®. This document is an agreement (“Agreement”) containing the terms and conditions that apply to the Pearl Prepaid Mastercard® that has been issued to you by Metropolitan Commercial Bank (Member FDIC) pursuant to a license from Mastercard International. “Metropolitan Commercial Bank” and “Metropolitan” are registered trademarks of Metropolitan Commercial Bank © 2014. By accepting and/or using this Card, you agree to be bound by the terms and conditions contained in this Agreement. The “Program Manager” for the Pearl Prepaid Mastercard is Praxell, Inc. and the Customer Service telephone number is 855-506-9732 or the toll-free telephone number on the back of your Card. In this Agreement, “Card” means the Pearl Prepaid Mastercard issued to you by the Bank, including any Physical Card (as defined below) you may request, as permitted under this Agreement. “Card Account” means the records we maintain to account for the value of transactions associated with the Card. “You” and “your” means the person or persons who have received the Card and who are authorized to use the Card as provided for in this Agreement. “We,” “us,” “our,” and “Bank” mean Metropolitan Commercial Bank, together with its successors and assigns. “Program Manager” means Praxell, Inc., together with its successors and assigns. The Card will remain the property of the Bank and must be surrendered upon demand. The Card is nontransferable, and it may be canceled, repossessed, or revoked at any time without prior notice subject to applicable law. Please read this Agreement carefully and keep it for future reference.

To help the government fight the funding of terrorism and money laundering activities, federal law requires all financial institutions and their third parties to obtain, verify, and record information that identifies each person who obtains a Card. What this means for you: When you apply for a Card, we will ask for your name, address, date of birth, social security number or country identification number, and other information that will allow us to identify you. We also may ask to see your driver’s license or other documentation bearing your photo as verification of your identity. By participating in the Card program, you agree that the information and statements you provide to us are accurate, including, but not limited to, your real name, valid U.S. mailing address and residential address (if different), social security number or other identification documentation, date of birth, and telephone number. If you fail to provide accurate information that we request, we may cancel your Card. In addition, funds tied to suspected illicit or illegal activity may be subject to both internal and potentially federal investigation. We reserve the right to restrict or delay your access to any such funds.

2. Your Card. The Card is a prepaid card. The Card allows you to access funds loaded or deposited to your Card Account by you or on your behalf. The funds in your Card Account will be FDIC-insured once we have verified your identity. You may access the funds in your Card Account by using your Card, Card Number, or by automated clearinghouse (“ACH”) debit using your Account Number. The Card is not a credit card. The Card is not a gift card, nor is it intended for gifting purposes. You will not receive any interest on your funds on the Card. The funds in your Card Account will not expire, regardless of the expiration date on the front of your Card.

3. FEES. THE FEES RELATING TO THE USE (AND MISUSE) OF YOUR CARD ARE SET FORTH IN THE “SCHEDULE OF FEES AND CHARGES (SCHEDULE A)” ATTACHED TO THIS AGREEMENT AND INCORPORATED HEREIN BY REFERENCE. FEES INCURRED PURSUANT TO THE TERMS OF THIS AGREEMENT WILL BE WITHDRAWN FROM YOUR CARD ACCOUNT AND WILL BE ASSESSED SO LONG AS THERE IS A REMAINING BALANCE IN YOUR CARD ACCOUNT, UNLESS PROHIBITED BY LAW. You agree to pay all fees associated with the Card. We may from time to time amend the Fee Schedule at our sole discretion as set forth in the Section of this Agreement titled “Amendment and Cancellation.”

3. Authorized Users. You may not request an additional Physical Card (“Secondary Card”) to allow another person to access the funds in your Card Account. If you permit another person to have access to any Card or Card Number, you are liable for all transactions made with any Card, Card Number or Account Number, and all related fees incurred, by those persons. To cancel your Card, telephone the toll-free number on the back of your Card, 855-506-9732 and you must follow-up not later than 10 business days with the written notification to revoke (cancel) permission for any person you previously authorized to use your Card. Until we have received your notice of such a revocation (cancellation) and have had a reasonable time to act upon the written notification of cancellation, you are responsible for all transactions and fees incurred by you or any other person you have authorized. If you tell us to revoke (cancel) your Card, we may revoke (cancel) your Card and issue a new Card with a different Card Number and/or Account Number. You are wholly responsible for the use of your Card according to the terms of this Agreement, subject to the Section labeled “Lost or Stolen Cards/Unauthorized Transfers” below, and other applicable laws.

4. Card Account Use and Purpose. Subject to the limitations set forth in this Agreement, you may use your Card, Card Number, or Account Number, as applicable, to (1) add funds to your Card Account (as described in the Section below titled “Adding Funds to Your Card Account”), (2) transfer funds between Card Accounts, (3) purchase goods or services wherever your Card is honored as long as you do not exceed the value available in your Card Account or the Daily Purchase Limit (as defined in the table below), and (4) withdraw cash from your Card Account (as described in the Section below titled “Using Your Card to Get Cash.” There may be fees associated with some of these transactions. For fee information, see the “Schedule of Fees and Charges (Schedule A)” attached to this Agreement. You agree not to use your Card for illegal gambling or any other illegal purpose.

You will be provided with our routing number and assigned a 16-digit Account Number once your identity has been verified. Our routing number and your assigned Account Number are for the purpose of initiating direct deposits to your Card Account and authorized automated clearinghouse (“ACH”) debit transactions only. The 16-digit Card Number embossed or printed on your Card should not be used for these types of transactions or they will be rejected. You are not authorized to use our routing number and Account Number if you do not have sufficient funds in your Card Account. These debits will be declined, and your payment will not be processed. You also may be assessed an ACH Decline Fee (see the “Schedule of Fees and Charges (Schedule A)” attached to this Agreement).

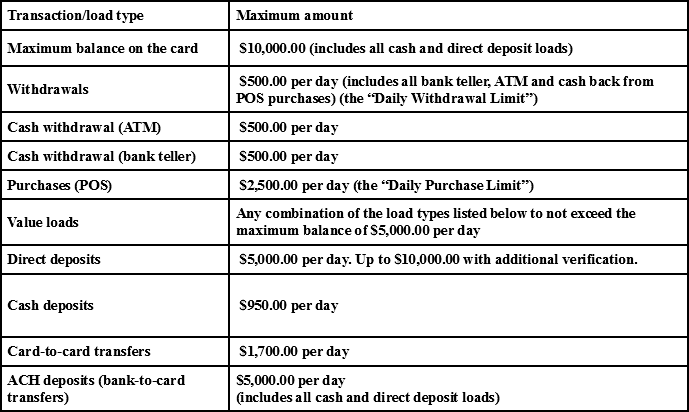

5. Limitations on Frequency and Dollar Amounts of Transactions. The total amount of purchases that you can perform in any single day is limited to the Daily Purchase Limit and the total amount of cash withdrawals (including withdrawals from a teller inside a bank office) that you can perform in any single day is limited to the Daily Withdrawal Limit (as defined in the table below). The maximum aggregate value of your Card Account(s) may not exceed $10,000.00 at any time. The maximum value will be determined by aggregating the activity and value of all Card Accounts you may have with the Program. For security reasons, we may further limit the number or dollar amount of transactions you can make with your Card. The following grid is provided in order to highlight the frequency and limitations of cardholder transactions in a single day or additional time frame if warranted:

6. Personal Identification Number (“PIN”). We will give you a PIN that you may use with your Card once your identity has been verified. Only one PIN will be issued for each Card Account. You will need a PIN to obtain cash at an ATM or to make a PIN purchase or obtain cash back at a point-of-sale (“POS”) terminal. You should not write or keep your PIN with your Card. If you believe that anyone has gained unauthorized access to your PIN, you should immediately call the number on the back of your Card, 855-506-9732, or send notice through go.cardportal.us, or write to the Program Manager at Praxell, Inc. – Pearl Prepaid Mastercard, P.O. Box 315, New York, NY 10018.

7. Adding Funds to Your Card Account. You may add funds to your Card (called “value loading” or “loading”) at any time. The maximum load amount is $5,000.00. Note: Some reload locations may have additional limits on the minimum amount you may load to your Card. The maximum aggregate value of funds in your Card Account(s) may not exceed $10,000.00 at any time. You agree to present the Card and meet identification requirements to complete value load transactions as may be required from time to time. Load locations may have their own load limits that may be less than our allowable amount. Load locations also may assess a fee to load funds to your Card Account. You also may direct deposit funds to your Card Account by providing our routing number and your assigned Account Number to your employer or other direct deposit payor (as described in the Section above titled “Card Account Use and Purpose”). You cannot load your Card Account by check or money order.

8. Using Your Card to Get Cash. With a PIN, you may use your Card to (i) obtain cash or check your balance at any Automated Teller Machine (“ATM”) that bears the Mastercard® or Cirrus® or Pulse brands, or (ii) obtain cash at merchants or banks that have agreed to provide cash back at POS terminals bearing the Mastercard® or Maestro® brands. All ATM transactions are treated as cash withdrawal transactions. The maximum amount of cash you may withdraw at an ATM on a daily basis is $500.00 as described in the Section above titled “Limitations on Frequency and Dollar Amounts of Transactions.” We may limit the amount of any individual ATM withdrawal, and merchants, banks and ATM operators may impose additional withdrawal limits. You will be charged a fee by us for each cash withdrawal and balance inquiry made at an ATM or cash withdrawal obtained through a bank teller, in the amount disclosed in the accompanying “Schedule of Fees and Charges (Schedule A).” In addition, when you use an ATM not owned by us, you may be charged a fee by the ATM operator or any network used (and you may be charged a fee for a balance inquiry even if you do not complete a fund transfer).

9. Transactions Using Your Card Number. If you initiate a transaction without presenting your Card (such as for a mail order, internet or telephone purchase, or an ACH debit purchase), the legal effect will be the same as if you used the Card itself.

10. Your Obligation for Negative Balance Transactions. Each time you initiate a Card transaction, you authorize us to reduce the funds available in your Card Account by the amount of the transaction and all associated fees. You are not allowed to exceed the available amount in your Card Account through an individual transaction or a series of transactions (creating a “negative balance”). Nevertheless, if any transactions cause the balance in your Card Account to go negative, including any purchase transactions where the retailer or merchant does not request authorization, you shall remain fully liable to us for the amount of any negative balance and any corresponding transaction fees. You may also be liable for any related Insufficient Funds/NSF Fee(s) as set forth in the accompanying “Schedule of Fees and Charges (Schedule A).” We reserve the right to bill you for any negative balance or to recoup such negative balance from any other Card we have issued to you. You agree to pay us promptly for the negative balance and any related fees. We also reserve the right to cancel your Card if you create one or more negative balances with your Card.

11. Business Days. Our business days are Monday through Friday, excluding federal and legal banking holidays in the State of New York.

12. Authorization Holds. You do not have the right to stop payment on any purchase transaction originated by use of your Card, other than a Recurring Transaction as described in the Section below titled “Recurring Transactions.” When you use your Card to pay for goods or services, certain merchants may ask us to authorize the transaction in advance and the merchant may estimate its final value. When you use your Card to obtain cash at an ATM or from a bank teller, we will authorize the transaction in advance (including all applicable fees). When we authorize a purchase transaction, we commit to make the requested funds available when the transaction finally settles, and we will place a temporary hold on your Card’s funds for the amount indicated by the merchant. If you authorize a transaction and then fail to make a purchase of that item as planned, the approval may result in a hold for that amount of funds. Car rentals, hotels and other serviceoriented merchants may choose to factor in additional amounts upon check-in, and it may take up to 60 days after your stay or your rental to have any excess amounts held by the hotel or rental company added back to your available balance. Similarly, some gas stations may factor in additional amounts to cover potential filling of the tank; if you want to avoid such a hold, you may want to pay inside the gas station, instead of paying at the pump. Until the transaction finally settles, the funds subject to the hold will not be available to you for other purposes. We will only charge your Card for the correct amount of the final transaction, and we will release any excess amount when the transaction finally settles.

When you use your Card at certain restaurants and service-oriented merchants, there may be an additional 20% (or more) added to the authorization to cover any tip you may leave on the purchase. If this occurs, and your total bill, after adding in the additional 20% (or more), exceeds the amount available on your Card, your transactions may be declined. Accordingly, you should ensure that your Card has an available balance that is 20% (or more) greater than your total bill before using your Card.

13. Recurring Transactions. If you intend to use your Card for recurring transactions, you should monitor your balance and ensure you have funds available in your Card Account to cover the transactions. “Recurring transactions” are transactions that are authorized in advance by you to be charged to your Card at substantially regular intervals. We are not responsible if a recurring transaction is declined because you have not maintained a sufficient balance in your Card Account to cover the recurring transaction. If these recurring transactions may vary in amount, the person you are going to pay should tell you, 10 days before each payment, when it will be made and how much it will be. (You may choose instead to get this notice only when the payment would differ by more than a certain amount from the previous payment, or when the amount would fall outside certain limits that you set.) If your Card was obtained through your employer or you receive electronic deposits of federal payments to your Card: If you have told us in advance to make regular payments (i.e., recurring transactions) from your Card Account, you can stop the payment by calling the number on the back of your Card, 855-506-9732, or by sending notice through go.cardportal.us or by mailing notice to Praxell, Inc.- Pearl Prepaid Mastercard, P.O. Box 315, New York, NY 10018, at least three business days before the scheduled date of the transfer. If you call, we also may require you to put your request in writing and get it to us within 14 days after you call. If you order us to stop one of these payments three business days or more before the transfer is scheduled, and we do not do so, we will be liable for your direct losses or damages. If you have authorized a merchant to make the recurring transaction, you also should contact the applicable merchant in order to stop the recurring transaction.

14. Preauthorized Credits. If you have arranged to have direct deposits made to your Card Account at least once every 60 days from the same person or company and you do not receive a receipt/statement (or paystub), you can call the number on the back of your Card or 855-506-9732 to find out whether or not the deposit was made, or go to go.cardportal.us.

15. Returns and Refunds. If you are entitled to a refund for any reason for goods or services obtained with your Card, you agree to accept credits to your Card Account for such refunds. You are not entitled to a check refund unless your Card has been closed. The amounts credited to your Card for refunds may not be available for up to five days from the date the refund transaction occurs.

16. Card Cancellation and Suspension; Limits. We reserve the right, in our sole discretion, to limit your use of the Card, including limiting or prohibiting specific types of transactions. We may refuse to issue a Card, revoke Card privileges or cancel your Card with or without cause or notice, other than as required by applicable law. If you would like to cancel the use of your Card, you may do so by calling the number on the back of your Card or 855-506-9732. You agree not to use or allow others to use an expired, revoked, canceled, suspended or otherwise invalid Card. Our cancellation of Card privileges will not otherwise affect your rights and obligations under this Agreement. If we cancel or suspend your Card privileges through no fault of yours, you will be entitled to a refund as provided below in the Section titled “Amendment and Cancellation.” Not all services described in this Agreement are available to all persons or at all locations. We reserve the right to limit, at our sole discretion, the provision of any such services to any person or in any location. Any offer of a service in this Agreement shall be deemed void where prohibited. We can waive or delay enforcement of any of our rights under this Agreement without losing them.

17. International Transactions. If you initiate a transaction in a currency or country other than the currency or country in which your Card was issued, you may be charged a fee (including credits and reversals) as set forth in the “Schedule of Fees and Charges (Schedule A)” attached to this Agreement. This fee is in addition to the currency conversion rate. If the transaction is in a currency other than the currency of the country in which your Card was issued, the merchant, network, or card association that processes the transaction may convert the transaction (including credits and reversals) into the currency of your Card in accordance with its policies and rates in effect at the time of the transaction. If Mastercard International (“Mastercard”) converts the transaction, it will establish a currency conversion rate for this convenience using a rate selected by Mastercard from the range of rates available in wholesale currency markets for the applicable central processing date which may vary from the rate Mastercard itself receives, or the government mandated rate in effect for the applicable central processing date.

18. Receipts. You should get or request a receipt at the time you make a transaction or obtain cash using your Card. You agree to retain your receipts to verify your transactions. You can get a receipt at the time you make any transfer from your Card Account using one of our ATM terminals.

19. Obtaining Balance and Transaction Information for Your Card; Periodic Statements Alternative. You should keep track of the amount of funds available in your Card Account. You may obtain information about the amount of funds you have remaining in your Card Account by calling the number on the back of your Card. This information, along with a 12-month history of account transactions, is also available on-line through our customer self-service website shown on the back of the Card. You also have the right to obtain a 24-month written history of account transactions by calling the number on the back of your Card or 855-506-9732, or by visiting go.cardportal.us, or by writing to Praxell, Inc. – Pearl Prepaid Mastercard, P.O. Box 315, New York, NY 10018.

20. Confidentiality. We may disclose information to third parties about your Card or the transactions you make using your Card: (1) where it is necessary for completing transactions; (2) in order to verify the existence and condition of your Card for a third party, such as a merchant; (3) in order to comply with government agency, court order, or other legal reporting requirements; (4) if you give us your written permission; (5) to our and the Program Manager’s employees, auditors, affiliates, service providers, or attorneys as needed; and (6) as otherwise provided in our Privacy Policy Notice below.

21. Our Liability for Failure to Complete Transactions. In no event will we or the Program Manager be liable for consequential damages (including lost profits), extraordinary damages, special or punitive damages. We will not be liable, for instance: (1) if, through no fault of ours or of the Program Manager, you do not have enough funds available in your Card Account to complete the transaction; (2) if a merchant refuses to accept your Card or provide cash back; (3) if an ATM where you are making a cash withdrawal does not have enough cash; (4) if an electronic terminal where you are making a transaction does not operate properly, and you knew about the problem when you initiated the transaction; (5) if access to your Card has been blocked after you reported your Card or Access Code(s) (“Access Code” includes your user ID(s), password(s), PIN(s), and any other access code or credential related to your Card Account) lost or stolen; (6) if there is a hold or your funds are subject to legal process or other encumbrance restricting their use; (7) if we or the Program Manager have reason to believe the requested transaction is unauthorized; (8) if circumstances beyond our or the Program Manager’s control (such as fire, flood or computer or communication failure) prevent the completion of the transaction, despite reasonable precautions that we or the Program Manager have taken; or (9) for any other exception stated in our Agreement with you.

Register your card for FDIC insurance eligibility and other protections. Your funds will be held at or transferred to Metropolitan Commercial Bank, an FDIC-insured institution. Once there, your funds are insured up to $250,000 by the FDIC in the event Metropolitan Commercial Bank fails, if specific deposit insurance requirements are met and your card is registered. See fdic.gov/deposit/deposits/prepaid.html for details.

No overdraft/credit feature.

Contact Praxell, Inc.-Pearl by calling 855-506-9732, by mail at Praxell, Inc. – Pearl Prepaid Mastercard, P.O. Box 315, New York, NY 10018, or visit go.cardportal.us.

For general information about prepaid accounts, visit cfpb.gov/prepaid.

If you have a complaint about a prepaid account, call the Consumer Financial Protection Bureau at 1-855-411-2372 or visit cfpb.gov/complaint.

Card Login

Card Login